If you are looking for TD Bank Interview Questions you have come to the right place.

We all know interviews are stressful and competition is intense.

However, with a small amount of preparation, you can ace the interview.

Here you will find frequently asked TD Canada Trust Interview Questions and Answers.

Note these are practice questions, and we are not affiliated with the mentioned company or able to guarantee specific questions.

Skip To

- Common TD Bank Interview Questions

- Company Information

- Banking Interview Questions

- TD Bank Teller Interview Questions

- Behavioral Interview Questions

- TD Bank Branch Manager Interview Questions

- TD Customer Experience Associate Interview

TD Bank Interview Questions and Answers

Can you tell us about yourself?

- It’s okay to talk about your hobbies and interests but keep it brief. Try and focus on related work experience. Remember having related work experience will put you ahead of the competition.

Why do you want to work for TD Bank?

- State you want to grow your career in banking and feel TD Bank is an excellent place to do it. Mention you could learn a lot about banking from one of the world’s leading online financial services firms, with more than 15 million active online and mobile customers in 2023.

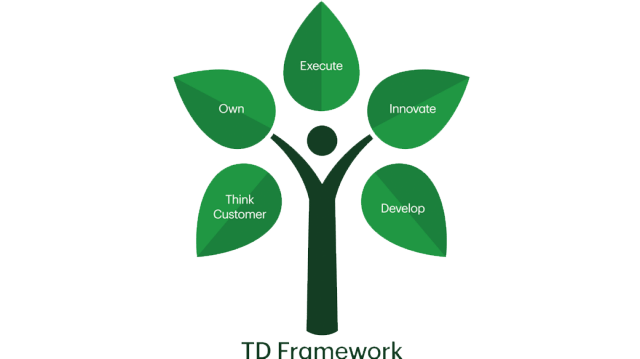

- State you are impressed with TD Bank’s training and development program which includes a tuition assistance program, eLearning courses, and classroom-based training/workshops.

- Have a look at the bank’s awards page and state several awards that you are impressed with.

- Say you believe in protecting the environment and are impressed with TD Bank’s Track Record. TD Bank is the first North American-based bank to go completely carbon neutral.

Why should TD Bank hire you?

- Look at the job description and find the essential skills and experience required to do the job. Reassure the interviewer that you have the skills and expertise necessary to do the position. Note your answer needs to demonstrate that you are the solution to the employer’s problem (a vacancy on their team) and that you are the best person for the role.

Where do you see yourself in five years?

- Take a look at other TD banking jobs and find a position you can see yourself doing in five years. If you say you want to stay in the banking industry you will sound like a good fit for TD Bank.

Strengths & Weaknesses

What is your greatest strength?

- The best way to respond to this question is to describe your skills and experience that directly correlate with the job you are applying for. With this in mind, review the job description and reassure the interviewer that you have the experience and skills to do the job.

What is your greatest weakness?

- You should not deny you have a weakness or state strengths as a weakness (I am a perfectionist, or I work too hard and neglect my friends and family). Consider a weakness that is required but not critical for the job and state that as your weakness.

- When you state your weakness make sure you say what you are doing to overcome that weakness. For example, I have a fear of public speaking and I have enrolled in a public speaking class to overcome my fear.

TD Bank Company Information

What can you tell us about TD Bank?

About TD Bank

- TD Bank is a Canadian Multinational National Bank headquartered in Toronto Canada.

- The bank’s business segments include Canadian Personal and Commercial Banking, U.S. Retail, Wealth Management and Insurance, and Wholesale banking.

- As of 2023, TD Bank has more than 27 million customers worldwide and 15.9 million active online and mobile users.

What is TD Bank’s vision?

- To be a better bank.

What is TD Bank’s purpose?

- To enrich the lives of our customers, communities, and colleagues.

Who are TD Bank’s competitors?

- Its competitors include BMO, CIBC, National Bank RBC, and Scotiabank.

TD Historical Facts

- A group of millers and merchants founded the Bank of Toronto in 1885.

- The Dominion Bank opened its first branch in 1871.

- Bank of Toronto and Dominion Bank merge in 1955 to form Toronto Dominion Bank.

- TD acquired Canada Trust in 2000.

- TD’s entrance into U.S. retail banking began with the acquisition of Banknorth in 2005.

Banking Interview Questions

What are some of the trends in the banking industry?

- Digital transformation: this includes the development and improvement of mobile banking apps, the use of artificial intelligence and machine learning, and the implementation of digital payment solutions (paying from your phone, smart watches, etc).

- Fintech: Examples of Fintech include robo-advisors, payment apps, peer-to-peer lending apps, and crypto apps.

- Social and environmental responsibility: There has been a growing trend among banks to prioritize social and environmental responsibility

What tips you would offer a customer to prevent fraud?

- Never share your password and change your password often.

- Never respond to emails or phone calls asking for your information.

- Enrol in TD Voice Print – voice recognition software

- Lock all your TD Cards, including Credit cards, Debit Cards, and online banking accounts.

What is overdraft protection?

- Overdraft protection is a service offered by banks that allow customers to overdraw their checking accounts for a fee. Having overdraft protection enables transactions to clear even when there aren’t enough funds in your account to cover the cost.

What overdraft protection types are you familiar with?

- Opt-In Overdraft Protection – a standard fee to spend more money than you have in your account.

- Linked Bank Account – if there is no money in your checking account it will take money from your savings account.

- Credit Card – link your credit cards to your checking account

- Credit Line – line of credit if you spend more than is in your account

TD Bank Teller Interview Questions

What interests you in the role of a bank teller?

Example: “I’m enthusiastic about the bank teller role due to my passion for exceptional customer service and finance. This role involves directly assisting customers with their financial needs, providing accurate transactions, and recommending other banking products that meet their requirements. Moreover, this position offers a valuable stepping stone for gaining industry experience and foundational knowledge for a future finance career.”

What do you think are the most important qualities for a bank teller to possess?

Example: “A successful bank teller should possess attention to detail, strong customer service skills, adaptability, integrity, and effective time management. I believe that these qualities enable a bank teller to provide exceptional service and contribute positively to the bank’s reputation and success.”

How would you deal with an upset customer?

- Show the customer you care.

- Listen and let the customer vent.

- Don’t blame the customer or the company.

- Try to solve the problem or find someone who can.

- Don’t make promises you can’t keep.

- Finally, it is important not to take it personally. If you get upset you will take it on future customers.

How would you define excellent customer service?

- The staff is knowledgeable in their field.

- The service is fast and accurate.

- The staff is always friendly.

Why is customer service so important?

- Great customer service can increase customer loyalty and cross-sell products. For example, if a customer is happy with their retail banking experience they may purchase financial products such as mutual funds or ETFs from TD.

Do you have any experience handling foreign currency or working with international customers?

- If you have experience in foreign transactions, that’s great. If you don’t, you need to be honest with your answer. Also, feel free to tell the interviewer about any foreign languages you speak.

TD Bank Behavioral Interview Questions

Can you name a time you disagreed with a co-worker and what was the outcome?

- It is only natural to have a conflict at work. What is important is how you and your colleague come up with a positive outcome. Review your current resume and think of examples of conflict and how you resolved them.

Can you tell me about a time when you received negative feedback from your manager? How did you handle it?

- Try to flip this question from a negative to a positive. State the negative, what you learned from it, and how you became a better employee.

Have you ever been in a situation where you had a big workload and felt overwhelmed? How did you deal with that?

- Mention you list out all your tasks and prioritize. Also, state you are not afraid to ask for help if necessary.

Tell me about a situation where you had to prioritize multiple tasks in a fast-paced environment. How did you manage your time?

- Provide an example of a situation where you had to juggle multiple tasks.

- Explain how you assessed the tasks’ urgency and importance.

- Describe the strategies you used to manage your time efficiently and meet deadlines.

- Emphasize the successful completion of tasks and how your time management skills contributed.

Describe a time when you identified an error in your work. How did you handle it?

- Explain the context in which you discovered the error.

- Detail the steps you took to investigate and rectify the mistake.

- Discuss any actions you took to prevent similar errors in the future.

- Highlight the importance of accuracy and accountability in your role.

TD Branch Manager Interview Questions

Can you describe your experience in leading and managing teams?

Example: “In my previous role as a Bank Branch Manager, I led and managed a diverse team of banking professionals. I believe in fostering open communication, recognizing individual strengths, and setting performance goals. I conducted one-on-one coaching sessions for feedback and career development.”

How do you motivate and inspire your team members to achieve their goals?

Example: “To motivate and inspire my team, I focus on recognizing individual strengths, providing clear communication about goals, and fostering a sense of purpose. I personalize tasks to align with each team member’s abilities, offer regular feedback, and lead by example with dedication and enthusiasm.”

How do you ensure excellent customer service within your branch?

Example: “Within my branch, I prioritize excellent customer service by fostering a customer-focused culture and providing thorough training to my team. We emphasize open communication, empowerment to make customer-centric decisions, and personalization of interactions. Through feedback analysis and continuous improvement efforts, we address pain points promptly. I lead by example, engaging with customers directly to showcase the level of service we aim to provide. These strategies collectively ensure a seamless and satisfying customer experience that aligns with our bank’s values.”

Give an example of a challenging situation you’ve faced as a manager and how you handled it.

Example: “One of my significant challenges as a manager was guiding my team through a major organizational restructuring. I focused on communication, explaining the reasons behind the changes, and highlighting growth opportunities. I provided one-on-one support, organized team-building activities for unity, and maintained open channels for questions and concerns.”

How do you support the professional growth and development of your team members?

Example: “I support my team members’ professional growth by creating individualized development plans tailored to their strengths and aspirations. Continuous learning opportunities are provided through workshops, courses, and self-study. I foster mentorship and coaching relationships within the team. Regular feedback and performance reviews highlight accomplishments and areas for improvement, while clear goal setting provides direction and purpose.”

Questions to ask at the end of the Interview

Questions to ask on a TD Bank Interview?

- What do you like best about working here?

- How would you describe your ideal candidate for this position?

- What about this position is the most important?

- How would you measure my success and what could I do to succeed in your expectations?

- Which part of the position has the steepest learning curve? What can I do to get up to speed quickly?

- What opportunities will I have to learn and grow?

TD Bank Interview Process

The TD Bank interview process involves several stages:

- Application Submission: Apply online with your resume and possibly a cover letter.

- Initial Screening: Expect a phone interview with a recruiter to discuss your background and interest.

- Assessment Tests: Depending on the role, you might need to complete skill assessment tests online.

- Interview Rounds: Multiple interview rounds, including phone or video interviews, behavioral interviews, and technical interviews if applicable.

- On-Site Interview: Some roles might require an in-person interview to meet the team and discuss your fit.

- Final Interview: A potential interview with senior management to assess your alignment with the organization’s goals.

- Reference Checks: TD Bank may contact your references to verify your work history.

- Offer: If successful, you’ll receive a job offer detailing the position and compensation.

TD Bank Interview Dress Code

Entry-Level Position

- Dress business casually if you are interviewing for an entry-level position. Do not wear shorts and avoid wearing jeans.

Management Position

- Dress formally or business casual if you are interviewing for a management position. Blazers and dark trousers are a safe choice, as well as wrap dresses for females. Avoid sportswear clothes.

Colours

- Blue tells employers that you’re credible and trustworthy.

- Black shows leadership and is great if you’re going for a senior position.

- Red sends a message that you’re assertive and works well in fields like sales.

- Orange is apparently the worst colour to wear for a job interview, with it being linked to unprofessionalism.

See Also

Please note we cannot guarantee the questions asked during the interview as we are not affiliated with the company mentioned in this post. These practice questions are designed to increase confidence. Worknearyou.ca takes no responsibility for the success or failure of your interview.